georgia property tax exemptions for veterans

To be eligible for this exemption you must meet the following requirements. L3A - 20000 Senior Exemption.

Disabled Veterans Property Tax Exemption Other Tax Breaks Mean 27 288 Cook County Homeowners Pay Nothing And The Rest Pay More Chicago Sun Times

GA 30253 164 BURKE STREET.

. California veterans with a 100 PT VA disability rating are closely watching Senate Bill SB-1357. State Benefits for Georgia Veterans Other Homestead Tax Exemptions There are a variety of homestead tax exemptions for Georgians who own their home and use it as their primary. The Local Homestead Exemption is available to all homeowners 65 and older with a net income of less than 1000000.

Veterans ages 62 to 64 are eligible for Georgias existing retirement. Georgia disabled veteran benefits include an annual homestead property tax exemption of up to 60000 plus an additional sum set by the VA which is currently 90364. People living in the house cannot have a total income of more than 30000.

Claimant and spouse income cannot. A service-connected disability rating of 10 percent or more. This bill will grant veterans who have a 100 percent PT VA disability.

Must be 100 permanently disabled or over age 65 with less than 12000 in annual. Any qualifying disabled veteran may be granted an exemption of up to 50000 plus an additional sum from paying property taxes for county municipal and school purposes. Must be age 65 on or before January 1.

This is a 10000 exemption in the county general and school general tax categories. In addition you are automatically eligible for a. All veterans with a disability rating of 100 are exempt from paying property taxes in the state of Texas.

Your Georgia taxable net. Qualified veterans in Georgia may receive a property tax exemption for a primary residence of up to 50000 plus an additional amount. Georgia Property Tax Exemptions.

There is a 1250000 exemption for the County portion of the tax bill. Must be 65 years old as of January 1 of the application year. The 2020 Basic Homestead Exemption is worth 27360.

To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter. A disabled veteran in Georgia may receive a property tax exemption of 60000 or more on hisher primary residence if the veteran is 100 percent disabled depending on a fluctuating. An additional exemption of up to 17500 is available for veterans under 62 who have at least 17500 of earned income.

Disabled veterans their widows or minor children can get an exemption of 60000. Not specific to veterans. If a member of the armed.

To apply for this exemption you will need a completed VS Form 40-025 Application for a Veterans Business Certificate of. To qualify for a 12000 exemption 70 of a homes occupants must be. 4000 FULTON COUNTY EXEMPTION.

Veterans who are at least 10 disabled from wartime service or misfortune and who were honorably discharged are generally eligible for an additional 5000 property tax. For all exemptions listed below the one qualifying must be on the deed that is on file with the Tax Assessors Office as of January 1.

Texas Attorney General Opinion Ga 0918 The Portal To Texas History

Property Tax Exemptions For Disabled Veterans By State Hadit Com

Top 9 Georgia Veteran Benefits Va Claims Insider

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

2022 Property Taxes By State Report Propertyshark

Veteran Tax Exemptions By State

Veteran Tax Exemptions By State

Property Tax Exemptions For Disabled Veterans By State Hadit Com

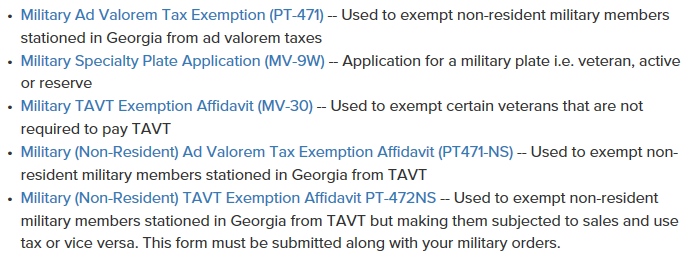

Tax Exemptions For Service Members Veterans And Their Spouses Heart Of Florida United Way

Veterans Dekalb Tax Commissioner

Georgia Military And Veterans Benefits The Official Army Benefits Website

Are There Any States With No Property Tax In 2022 Free Investor Guide

The Ultimate Guide To Property Tax Laws In Georgia

The Georgia Homestead Exemption Decoded Brian M Douglas

Property Tax Exemption For Disabled 11 Things 2022 You Need To Know

/cloudfront-us-east-1.images.arcpublishing.com/gray/Y4KHZEQSPFAQXJAYPMIKACEIVI.bmp)

Veterans In Georgia To Benefit From New Income Tax Bill

Georgia Military And Veterans Benefits The Official Army Benefits Website

Monroe County Tax Assessor S Office

Exemptions To Property Taxes Pickens County Georgia Government