when will estate tax exemption sunset

The current estate and gift tax exemption is scheduled to end on the last day of 2025. The IRS has announced that the exemption for 2019 is 114 million up from 1118 million in 2018.

The Federal Estate Tax Is Back Ppt Video Online Download

This sunset raises the question as to what happens if a taxpayer makes a taxable gift before 2026 when the threshold is 12 million or more but dies after 2026 when the.

. National median home sales price of. Unless your estate planning is. The estate planning environment has changed over the last decade.

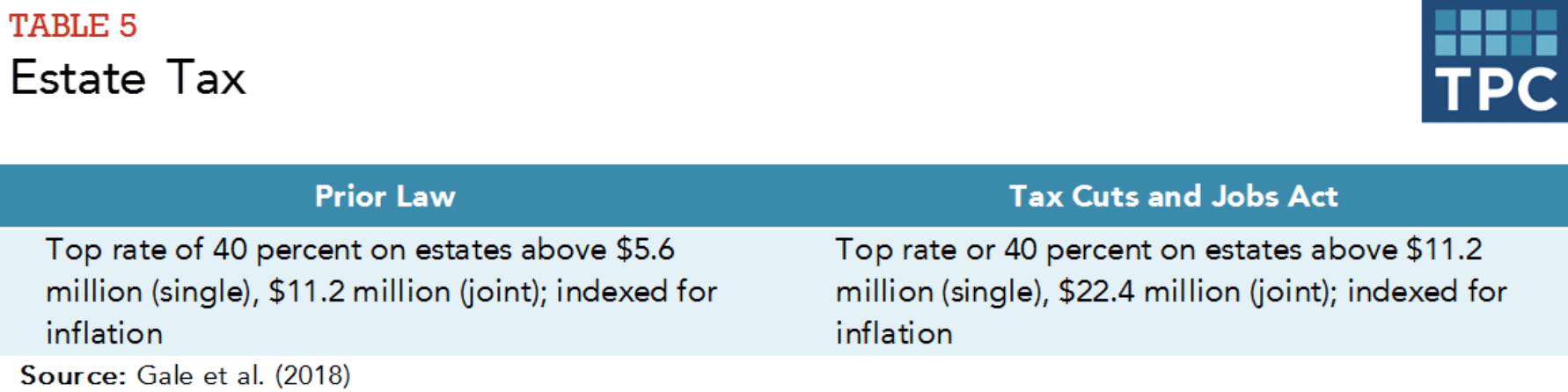

The tax reform law doubled the BEA for tax-years 2018 through 2025. When the calendar turns to 2026 the estate tax provisions implemented by the Tax Cuts and Jobs Act TCJA are due to expire or sunset. How did the tax reform law change gift and estate taxes.

Exclusion was extended through the 2023-24 fiscal year. The property tax incentive for the installation of an active solar energy system is in the form of a new. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with.

The statute is now scheduled. This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018. This set the stage for greater.

Under the current tax law the higher estate and gift tax exemption will sunset on December 31 2025. As always consult with your tax and legal. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation.

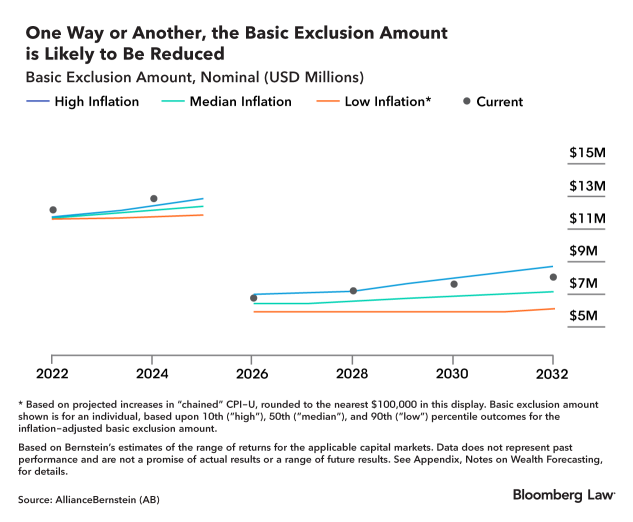

After that the exemption amount will drop back down to the prior laws 5 million cap. What happens to estate tax exemption in 2026. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation.

Because the BEA is adjusted annually for inflation the 2018. After 2025 the exemption amount will sunset a fancy way of. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation.

This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. This gives most families plenty of estate planning leeway. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes.

Website builders As 2026 approaches families who have more than 10M or individuals with more than 5M may be served well from making more than 5M of completed. Fast-forward to 2026 and the estate and gift tax exemption. And the 2022 estate tax exemption is.

1 day agoIt indicates both the annual property tax on a median-value home in the state and for comparison what the property tax would be on the US. For instance a married. The landmark Taxpayer Relief Act of 1997 called for a gradual increase in the estate exemption from 600000 in 1997 to 1 million by 2006.

Maybe not tomorrow but the sunset of our historically high estate tax exemptions is comingand with the election on its way it could be sooner than you think. In 2018 the Tax. Fast-forward to 2026 and the estate and gift tax exemption.

Starting January 1 2026 the exemption will return to 5 million adjusted for inflation. The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

Keep in mind the higher estate tax exemptions sunset at the end of 2025 and will shrink to about 7 million to 8 million per person. The above exemptions sunset and revert to 5 million indexed for inflation2022 federal annual gift exclusion 16000 per year per donee. The federal estate tax exemption is set to sunset at the end of 2025.

Starting January 1 2026 the exemption will return to 549 million.

Create An Estate Plan Now To Take Advantage Of Big Tax Exemption

Farmers Ranchers Need Permanent Fix For Estate Tax Texas Farm Bureau

2021 Tax Laws Federal Tax Updates Maryland Estate Taxes Mcnamee Hosea

Insights Blog Intrust Advisors

Four More Years For The Heightened Gift And Tax Estate Exclusion

Gift And Estate Tax Planning In 2021 Baker Tilly

Potential Estate And Gift Tax Threat What To Do Now Lfs Wealth Advisors

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

Four More Years For The Heightened Gift And Tax Estate Exclusion

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Federal Estate Tax Exemption 2021 Cortes Law Firm

Heirs Inherit Uncertainty With New Estate Tax The New York Times

Estate Tax Current Law 2026 Biden Tax Proposal

9 Estate Planning Resolutions For The New Year Buckley Law P C

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

Decomposing The Decline In Estate Tax Liability Since 2000 Penn Wharton Budget Model